De-banking The Right, Ignoring The Left

Trump Supporters De-banked, Biden's Banking Ignored.

Note: It been awhile and I couldn’t pass up posting this.

Marc Andreessen exposes debanking of tech start-up founders who are seen as threats to financial industry

Tech billionaire and venture capitalist Marc Andreessen appeared on "The Joe Rogan Experience," where he delved into the topic of debanking, a practice he claims has disproportionately targeted right-leaning individuals and businesses.

Andreessen explained that debanking occurs when an individual or company is removed from the banking system, losing access to accounts and becoming unable to make financial transactions. He claimed that under current banking regulations, there is a category called a “politically exposed person" (PEP) and if a person falls under this category then financial regulators are required to kick them out of their bank.

Andreessen went on to claim that this standard has been exclusively applied to right-wing voices and he is not aware of anyone on the left who has faced such consequences. He explained that although there are constitutional protections for a person’s freedom of speech, nothing in the Constitution bars the government from putting pressure on private banks to debank specific individuals or companies.

Can listen below:

The following is from an unrolled thread by Andrew Torba, the owner of GAB social media platform:

Yesterday venture capitalist Marc Andreessen highlighted Operation Chokepoint 2.0 on Joe Rogan's show. He noted how 30 tech founders were targeted and debanked by the Biden administration for purely political purposes, I was one of them. This is our story.

Operation Choke Point was an initiative launched by the United States Department of Justice in 2013, under the Obama administration. The program aimed to discourage banks and financial institutions from doing business with companies that the government deemed to be high-risk, such as payday lenders, firearms dealers, and certain types of telemarketers.

The operation involved federal agencies, including the Department of Justice, the Federal Trade Commission (FTC), and the Consumer Financial Protection Bureau (CFPB), working with banks to identify and cut off financial services to these high-risk industries. The idea was to "choke off" the financial lifeblood of these businesses, making it difficult for them to operate.However, critics argued that the program went too far, infringing on the rights of businesses that were not necessarily engaged in fraudulent activities. They claimed that the initiative targeted lawful industries and violated the First Amendment rights of businesses to engage in legal commerce. The operation generated controversy and faced legal challenges.

In 2017, the Trump administration dismantled Operation Choke Point, with the Justice Department stating that it would no longer support the program. While the initiative had the stated goal of targeting fraudulent businesses and protecting consumers, many argued that it overstepped its authority and unfairly targeted legitimate industries.In early 2021, within just a few weeks of Biden taking office Operation Chokepoint 2.0 was activated. Gab.com was one of the targets.

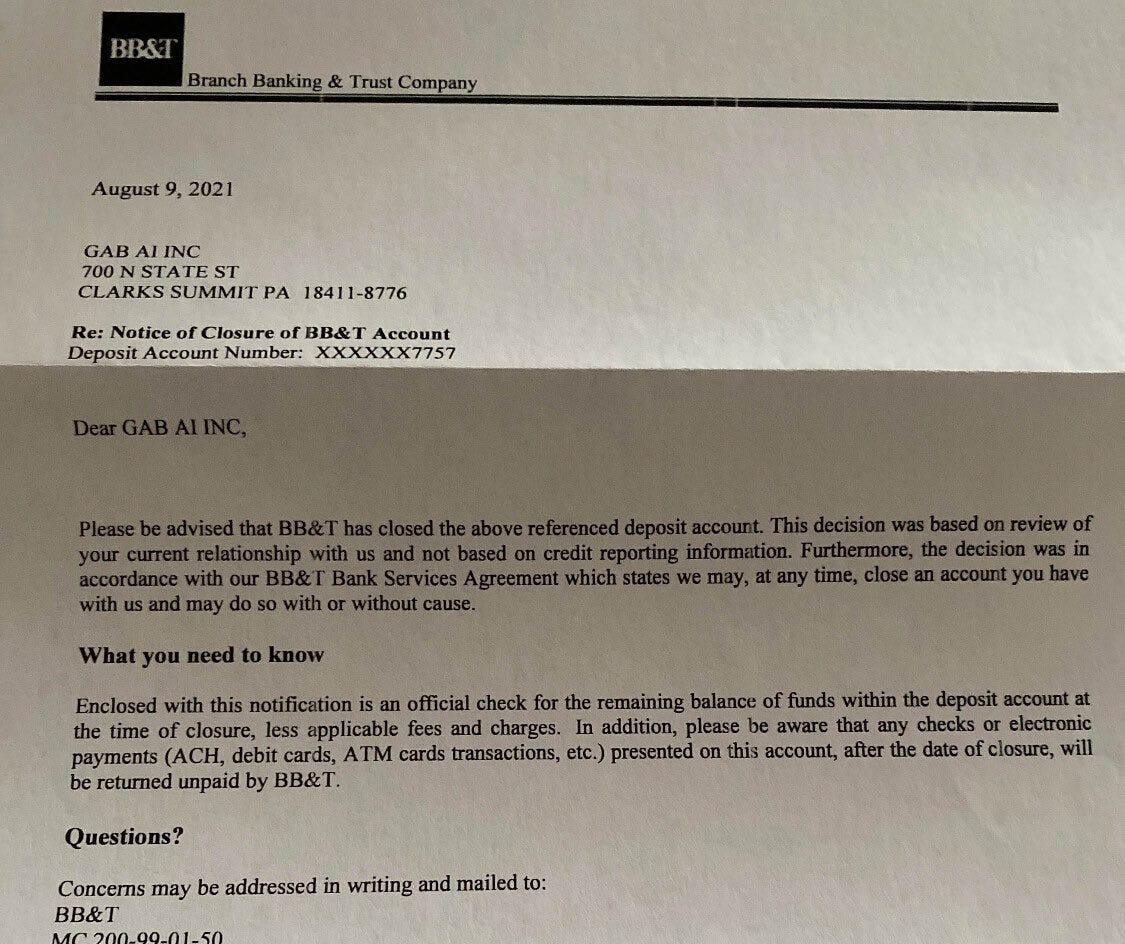

Gab follows the law and operates a legal business in the United States. We sell hats, shirts, advertising for businesses, and a software license to our GabPRO service. We have a community that respects law and order. Yet we had half a dozen banks and other services banning us left and right.Without a bank account you can't store and deposit cash. If you cannot store and deposit cash you cannot run payroll, pay bills, or operate a business. That's the point of Operation Chokepoint: to choke out the business so it no longer can exist.

I spent months opening new bank accounts and transferring millions of dollars to new accounts every other week. I tried big banks, credit unions, and even an explicitly "Christian" bank. They all banned us within a few weeks of opening the account.

The reason was always the same "because our terms say we can do so at anytime for any reason or no reason at all." What was really happening behind the scenes is that the banks were being pressured by the federal government to do this to us. I was told, off the record, by many of them that they were being intimidated and threatened with expensive audits and regulatory pressure.This wasn't the first time we dealt with financial deplatforming. In 2019/2020 we were wrongfully placed on the MATCH list for political reasons. We spent tens of thousands of dollars on legal fees and months of work getting off the MATCH list so that we could process credit and debit card payments again.

Thankfully we had bitcoin (free speech money) and paper checks. We taught Gab users how to buy and use bitcoin and thousands of people physically mailed us paper checks to our PO Box. That's how we survived for the better part of a year.

After months of playing whack-a-mole with banks and having millions of dollars up in the air, we finally found pro-free speech banking partners who were willing to stand up to the intimidation and keep a checking account open for us. As always, God protected and provided for us. While it wasn't easy, I'm thankful for this trial. It led to great relationships and opportunities to become even more resilient to these type of attacks. It also allowed us to stack a bunch of bitcoin and start building up Gab's bitcoin reserve treasury, which continues to produce for the business today.

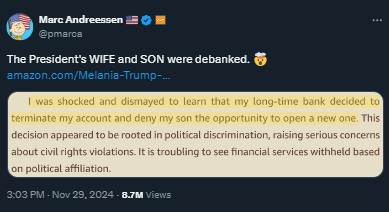

Barron Trump, mother were denied bank accounts due to 'cancel mob,' Melania says in new memoir

This is from an article back in 2021:

Here are other’s who were de-banked:

This is not out of malice, but because the custody providers fear being debanked themselves if they are deemed "too risky." It's debanking all the way down.

Now to the Biden’s:

This selective enforcement highlights how financial systems are weaponized against dissenting voices while shielding the politically connected.

Note: I put this together before Biden pardoned Hunter.

Related- Here is a good article about Biden pardoning Hunter:

From the above article:

Biden’s pardon of Hunter has granted his son immunity across an extensive range of potential offenses, effectively ensuring that he will not be held accountable for anything from financial fraud, tax evasion, and violations of the Foreign Agents Registration Act (FARA), to more serious allegations involving money laundering and influence peddling, which directly implicate his father's involvement in questionable business dealings. What Democrats once called a commitment to fairness and the justice system—promising that Hunter would be treated like any other citizen—has turned into an expansive act of clemency that would make any authoritarian blush. It seems that the claim of "no one being above the law" was merely a placeholder, used only until it became inconvenient.